Global inflation tracker: see how your country compares on rising prices

Simply sign up to the Global inflation myFT Digest -- delivered directly to your inbox.

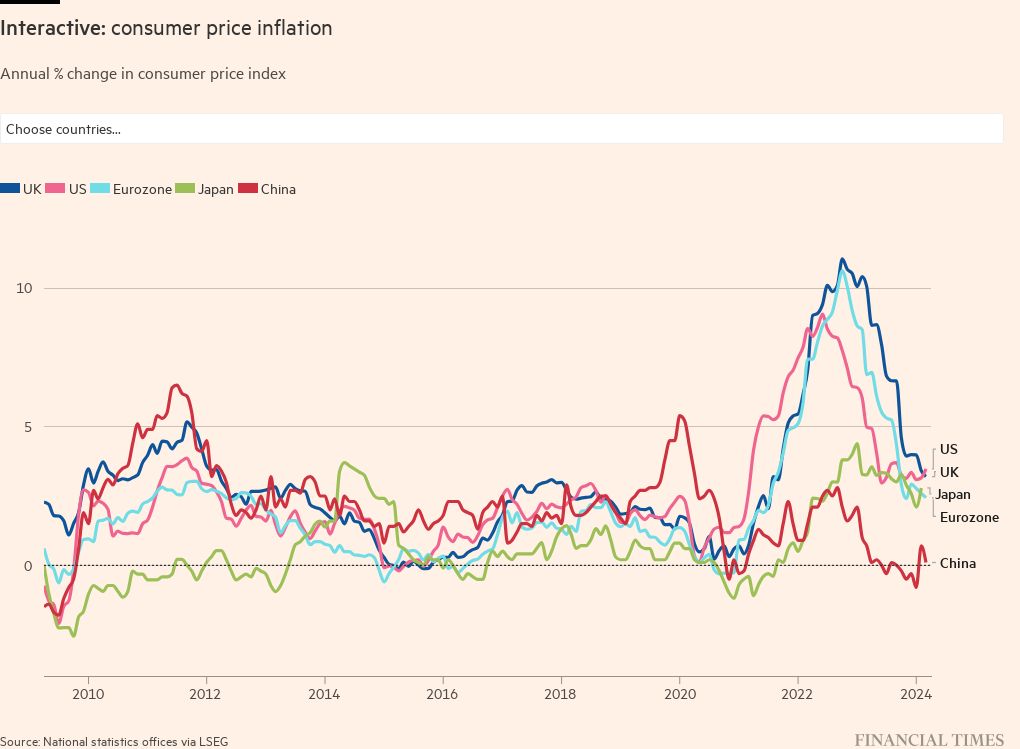

Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine.

The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.

This page provides a regularly updated visual narrative of consumer price inflation around the world.

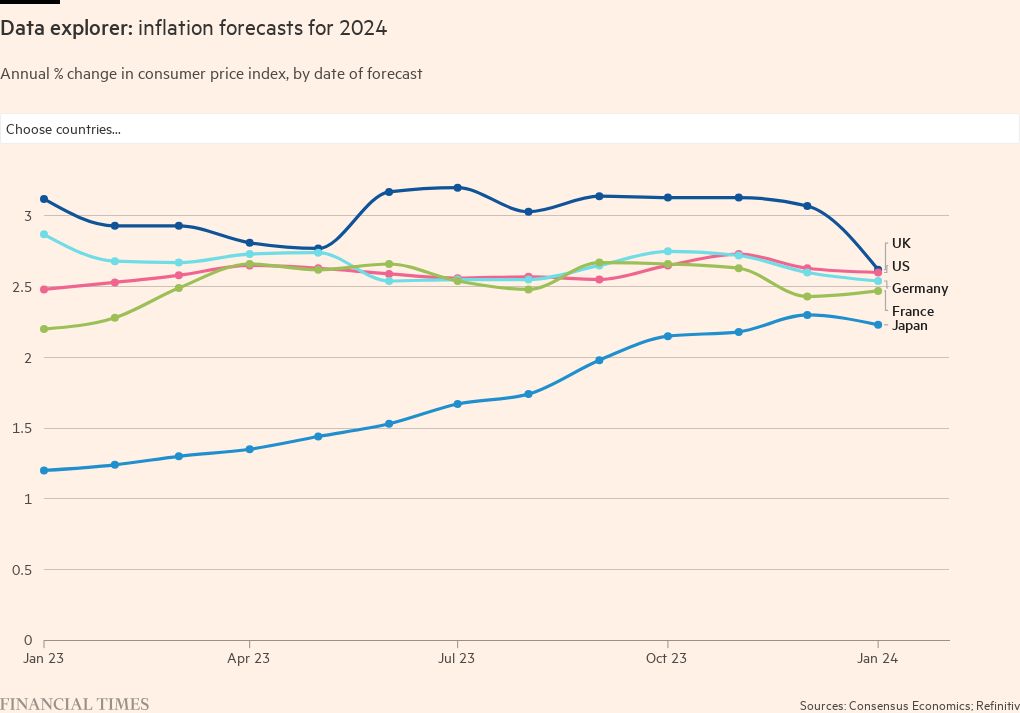

It includes economists’ expectations for the future, which show forecasts for inflation in several major economies have now stabilised. Including in the US, France and Germany, according to forecasters polled by Consensus Economics.

Investors’ expectations of where inflation will be five years from now have declined from their recent peaks.

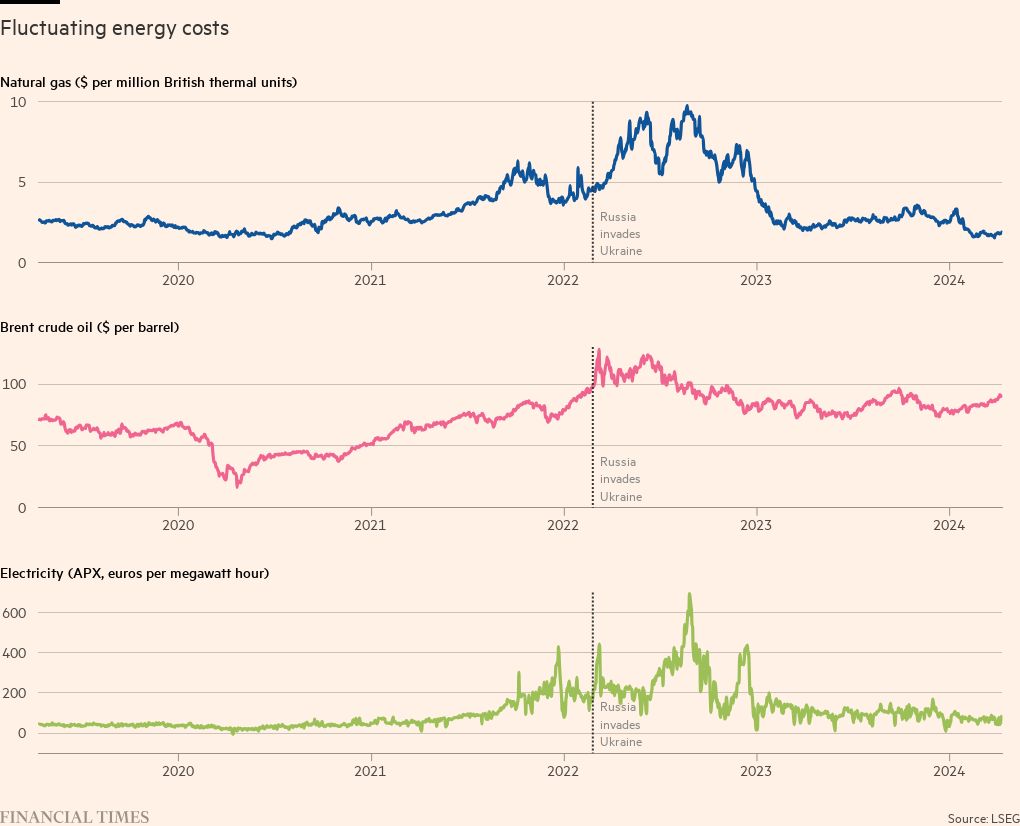

The rise in energy prices was the main driver of inflation in many countries, even before Russia invaded Ukraine. Daily data show how the pressure has intensified on the back of a conflict that has forced Europe to search for alternative gas supplies.

However, wholesale prices continue to ease as a result of weakening global demand and European gas storage facilities being filled close to capacity.

But energy prices still remain high by historical standards in many countries, particularly in Europe, where the crisis has been more intense.

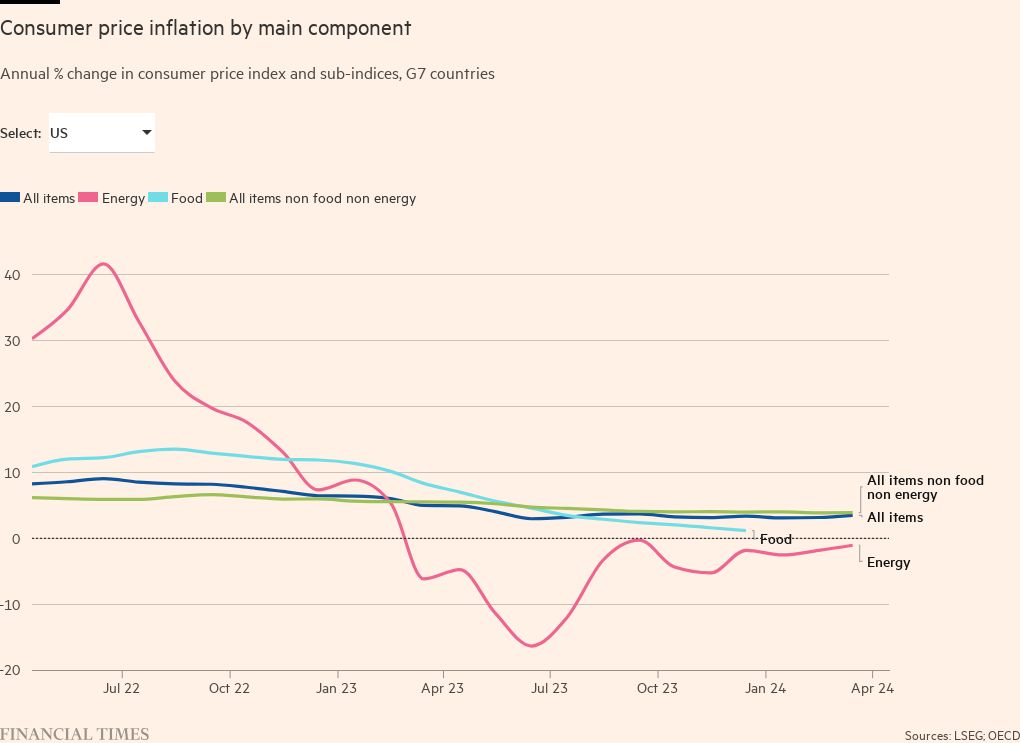

Higher inflation also spread beyond energy to many other items, with rising food prices hitting the poorest consumers in particular. However, food inflation is now showing signs of easing in most countries.

Rising prices limit what households can spend on goods and services. For the less well-off, this could lead to people struggling to afford basics such as food and shelter.

Daily data on staple goods, such as the wholesale price of breakfast ingredients, provide an up-to-date indicator of the pressures faced by consumers. While they have eased in recent months, they remain at high levels.

In developing countries, the wholesale cost of these ingredients has a larger impact on final food prices; food also accounts for a larger share of household spending.

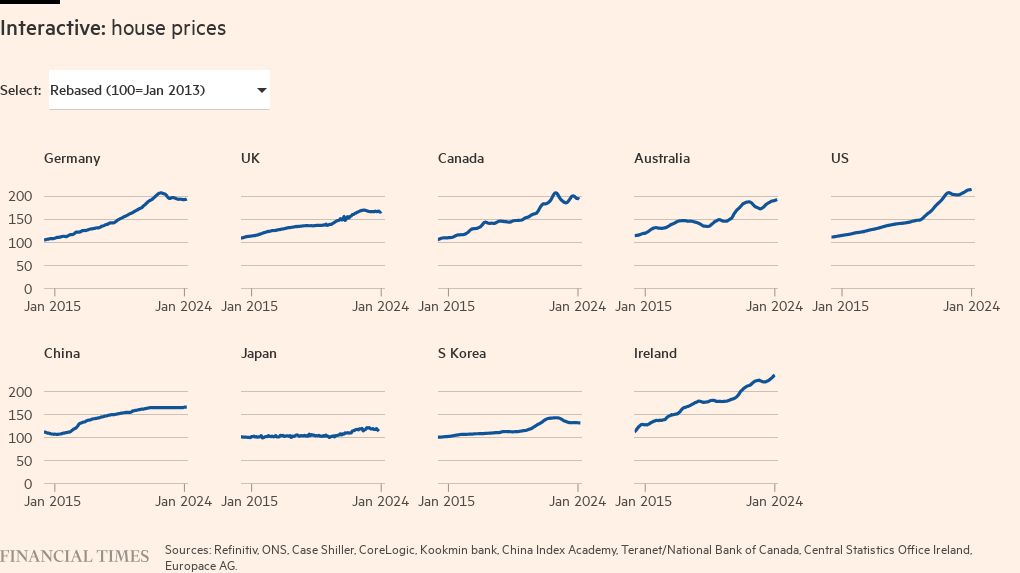

Another point of concern is asset prices, especially for houses.

These soared in many countries during the pandemic, boosted by ultra-loose monetary policy, homeworkers’ desire for more space and government income support schemes. However, higher mortgage rates are already leading to a significant slowdown in house price growth in many countries.

Letter in response to this report:

Planetary stress will be mainstream economics / From Jennifer Barker, London SW19, UK

Comments